Who We Are

Nearly fifty years ago, the Vermont General Assembly established the Bond Bank to provide loans for local infrastructure projects following a period of facilities construction across the state when the ability to secure long-term debt financing was at risk.

The solution embodied in the Bond Bank was a state instrumentality with a mandate to “foster and promote by all reasonable means” access to long-term debt financing while, to the extent possible, reducing related costs to taxpayers and residents.

Over the ensuing years, the Bond Bank has financed billions of dollars in local investment by purchasing and “banking” the bonds and notes of governmental units.The Bond Bank is governed by a five-member Board of Directors with four appointed by the Governor and the State Treasurer serving as an ex-officio member.

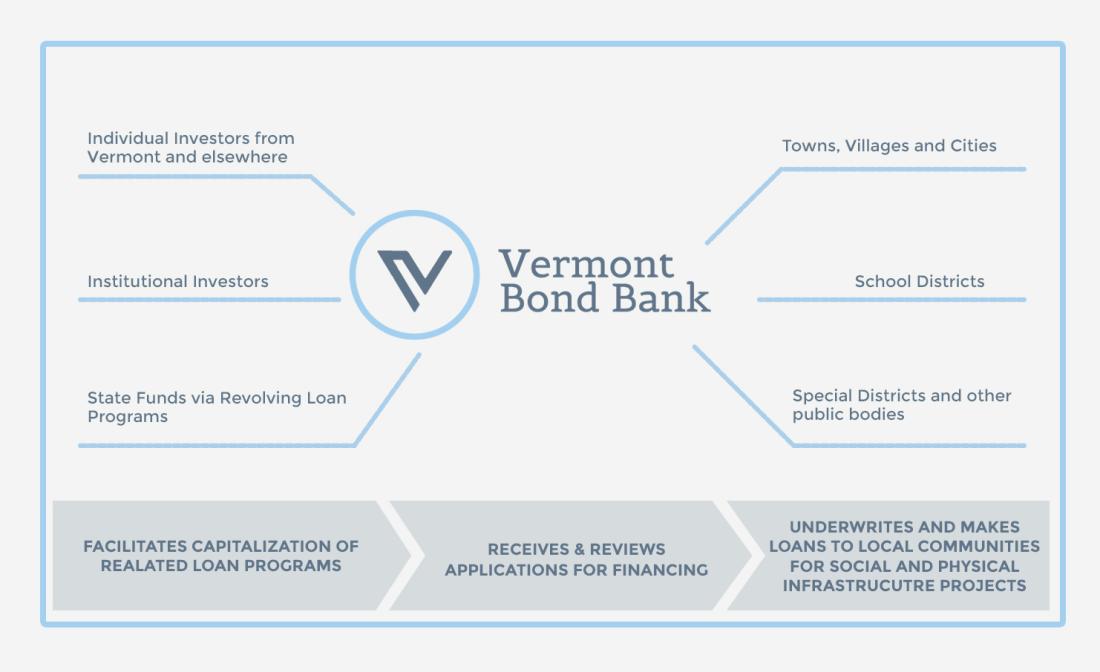

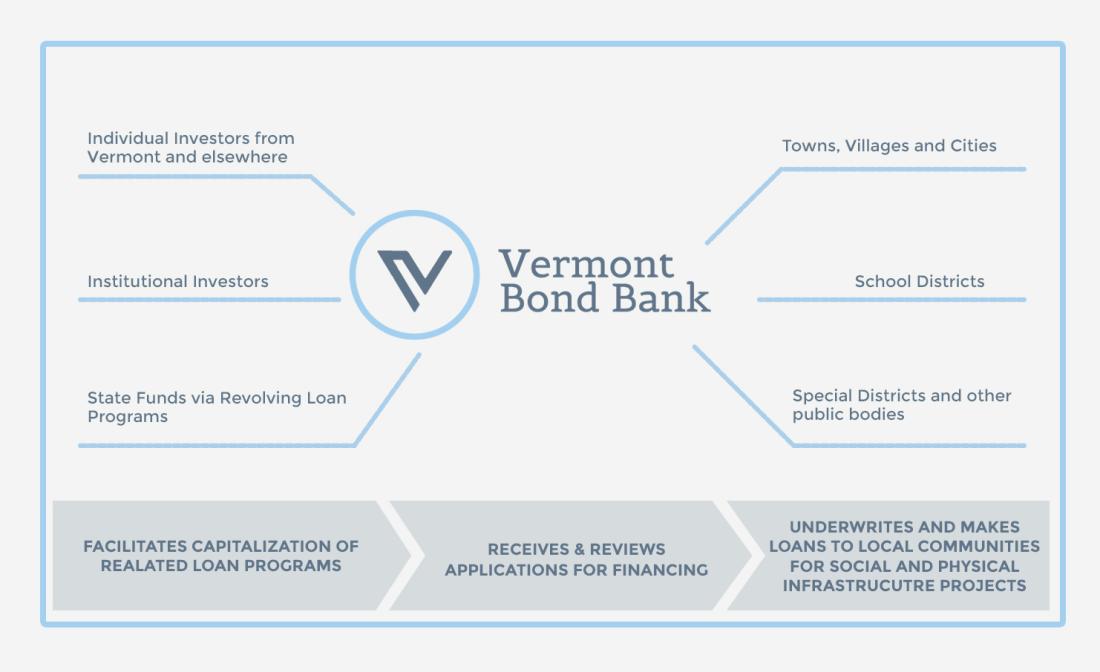

How We Work

The Bond Bank’s programs are financed by the issuance of tax-exempt bonds, grants, and state matching funds.In all cases, these funding sources allow low-cost financing to be passed along to our borrowers.

Our 2024 Impact

Our loan programs impact the daily lives of Vermonters across the state by financing the classrooms, roads, and water that make daily life possible. Learn more about our impact on community well-being here.

Full Report200,000

Vermonters Impacted

50

Acres of Park Improvements

300,000

SQ FT Public Facilities Upgraded

2

miles of streetscape and trails improved