Pooled Loans

The Pooled Loan Program has provided over $2 billion in low-cost loans to Vermont governmental units for long-term capital projects over its 50-year history. Loans are primarily funded through the issuance of highly rated tax-exempt bonds by the Bond Bank.

Common uses of loans issued through the program include:

- Facilities renovation and construction projects

- Road and highway improvements

- Energy efficiency upgrades

- Equipment purchases

- General infrastructure

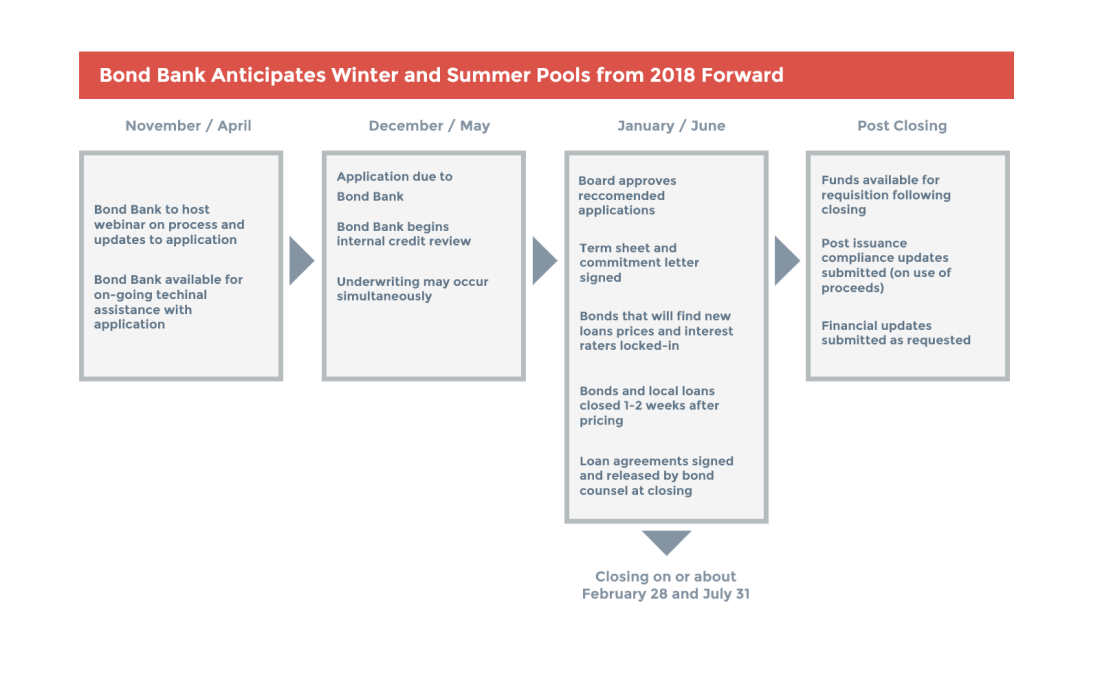

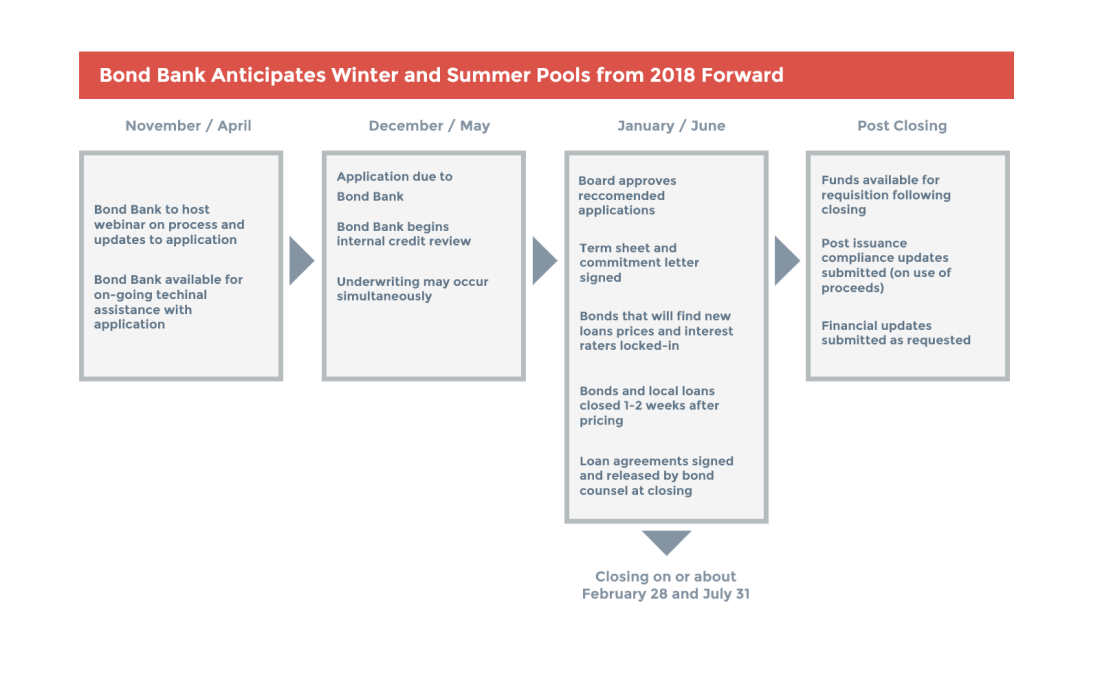

Loans are made through the Pooled Loan Program in the winter and summer following the receipt of an application and approval by the Bond Bank’s Board.

| Program Requirements |

|---|

|

Loan Process

Most borrowers begin their loan process by contacting the Bond Bank early on to receive an illustrative debt service schedule that can be used for the purposes of estimating potential budget impacts. Borrowers then formally apply to the Bond Bank following engagement of local bond counsel and approval to issue the bond.

| Advantages | Considerations |

|---|---|

|

|

Terms & Repayment

Follow the link to understand the timing of the Pooled Loan Program as well as details on the loan terms and repayment process.

Approved Legal Counsels

Local bond counsel serves a critical role in confirming the legality of our borrower’s debt issuances. Early engagement of local counsel will ensure that they will be able to provide a preliminary legal opinion alongside a loan application to the Bond Bank.